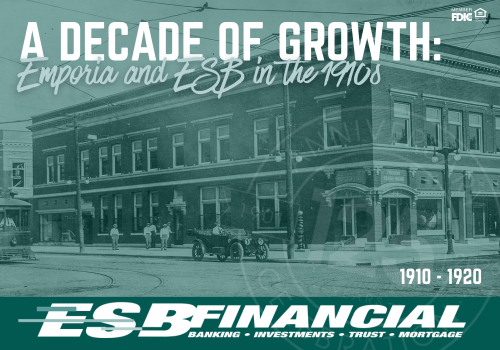

A Decade of Growth: Emporia and ESB in the 1910s

02/26/2026

The 1910s were a decade of transformation for both Emporia and ESB. As the city's population grew and the world faced the challenges of World War I, ESB expanded right alongside the community. From a $30,000 remodel in 1913 to promoting Liberty Bonds and introducing safe deposit boxes, the bank remained a steady presence during a time of rapid change. Even then, the focus was the same as it is today - helping families save, plan, and build for the future.

Read More

ESB Announces Promotion of Kim LoPorto to Vice President

02/04/2026

Kim LoPorto's promotion to Vice President recognizes her dedication to supporting ESB Financial's team members and strengthening the bank's culture. Through her work in Human Resources, Kim plays an important role in leadership development, team support, and fostering collaboration across the organization. Her commitment to the ESB Way and her passion for building strong relationships continue to help ESB grow and serve its communities.

Read More

ESB Announces Promotion of Kandace Wakeman to Assistant Vice President

02/06/2026

Kandace Wakeman's promotion to Assistant Vice President recognizes her role in shaping how ESB Financial shares its story across the communities it serves. As Marketing Officer, Kandace focuses on thoughtful, consistent marketing that reflects ESB's history, family ownership, and commitment to relationship banking. Her work helps connect the bank's legacy with the clients, businesses, and communities it serves today.

Read More

ESB Announces Promotion of Eric Porter to Senior Vice President

02/02/2026

Eric Porter's promotion to Senior Vice President reflects his long-standing commitment to relationship-driven banking and serving clients with care and consistency. As a commercial lender, Eric is known for taking the time to understand each client's goals and providing solutions that fit their unique needs. His people-first approach, focus on long-term relationships, and dedication to community banking continue to play an important role in the success of both his clients and the communities ESB serves.

Read More

Life in Emporia at the Turn of the Century

01/28/2026

When ESB Financial was founded in 1901, Emporia was a growing railroad town where families carefully managed every dollar they earned. From the cost of everyday items to wages and major purchases, budgeting and planning were essential. This article looks back at life in Emporia during the early 1900s and how those financial realities shaped the values that still guide ESB Financial today.

Read More